The purpose and effectiveness of board committees

Hans-Kristian Bryn is a senior risk management and governance adviser focused on value enhancement and protection. He leads complex risk management and governance engagements for both boards and EXCOs of FTSE 100 and 250 corporates, as well as Private Equity owned firms. He is also a thought leader on topics such as disruption, risk appetite, risk-based decision-making, ESG, governance and reputational risk.

hanskristianbryn@aol.com https://www.linkedin.com/in/hanskristianbryn/

Carl Sjostrom is an independent senior adviser to company boards and management, working across Europe and with most industries and forms of ownership. With a focus on reward and performance, Carl is a frequent speaker and commentator on topics of strategy, executive pay and corporate governance issues from an international perspective.

carl@vitisolutions.com http://www.viti.solutions

Hans-Kristian Bryn and Carl Sjostrom look at the roles of the Audit & Risk and Remuneration Committees and suggest ways in which committee performance can be enhanced.

The regulatory and governance landscape facing companies is becoming more crowded and changes in demands as well as expectations are putting more pressure on boards individually and collectively. Our 2016 article1 raised a concern that the committees of the board often work in silos and we argued that a more collaborative approach would benefit both the Audit & Risk Committee (‘ARC’) and the Remuneration Committee (‘RemCo’). In this article we revisit the roles of the RemCo and the ARC (from a risk and governance perspective) highlighting areas that can be challenges for their respective Chairs and where we observe distinct differences between effective and less effective committee work.

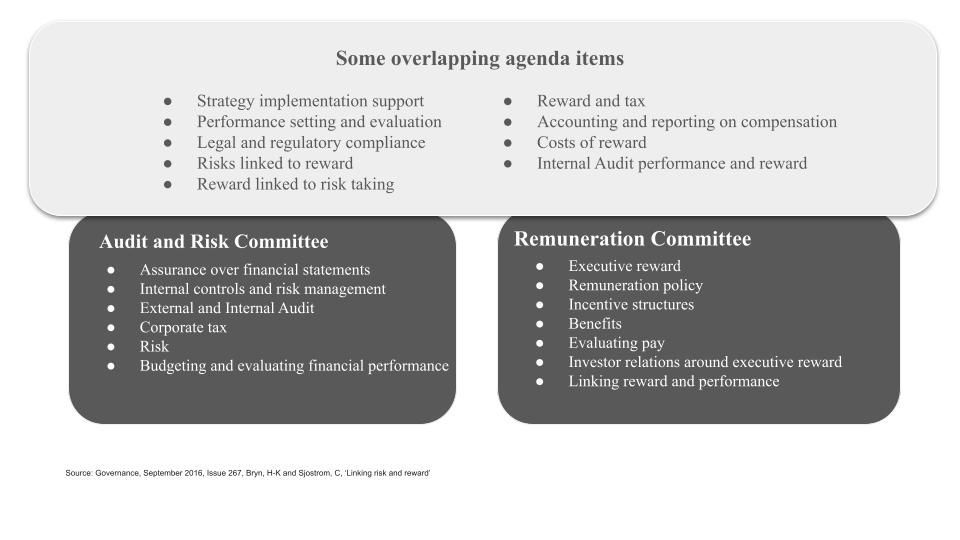

As we noted in our previous article, the reason boards appoint committees to deal with matters such as audit, risk and executive remuneration is primarily to manage the board’s workload by dividing it so that the committees’ attention to more detailed matters free up time to focus on critical strategic issues. In addition to achieving time efficiencies, committees are also able to hone specialist knowledge and processes, which in turn allow them to address the increasingly complex regulatory and governance matters associated with their topics. Our previous discussion on how to take advantage of overlapping committee work illustrates the key tasks of the ARC and the RemCo:

The illustration shows that the overlap of agendas needs to be managed. For example, the risk appetite of the business should be used as an input to evaluating the executive reward and incentives to ensure that they don’t encourage actions and behaviours that can lead to exposures triggering breaches of the risk appetite.

Over the past decades, the roles of ARCs and RemCos have changed significantly, not least in response to the evolutions of governance codes and regulatory reform. However, the specificity of these changes has left little room for fundamental reviews of the purpose and structures of committee work. Committees should not be over-reliant on strong leadership from the Chair and we observe that, in particular, the following remain common obstacles to effective committees for many companies:

- Lack of shared understanding of approach and organisational context;

- Information flows; and

- Complexity of solutions and processes.

Shared understanding of approach and organisational context

Most boards will be alert to the need for committees to have at least one member with ‘recent and relevant experience’ of the subject matter, for example appointing someone with CFO or audit experience to the ARC or HRD experience to the RemCo. However, we would argue that such experience is positive but not sufficient for an effective committee. It is equally as important for the committee to have established a shared understanding of the subject matter and the principles upon which the company should base its decisions.

Such principles may be summarised for the RemCo in a remuneration policy statement and for the ARC in a risk appetite statement, but what is critical is that the position is first established by creating a common understanding within the committee, and by extension the board in plenary, without creating barriers to constructive challenge and fresh thinking.

For the RemCo it is important that the shared understanding includes:

- How the key remuneration vehicles work;

- How remuneration is implemented throughout the company;

- The history of remuneration at the company; and

- The principles and philosophy that underpin decision-making.

Many RemCos fail on the first hurdle of how key remuneration vehicles work. Salary, pensions, benefits and short- and long-term incentives tend to have local variations but also terminology that mean different things to different people. For example, in Europe it is customary to set annual bonus opportunities with reference to 100% being a maximum, whereas in the US it is more common to refer to 100% as pay for an expected, or target, level of performance.

It is therefore important to understand how remuneration is implemented – both in terms of how it differs for different parts of the organisation and what the intentions are, so that committee members with diverse experience have the same reference points. For example, in some industries where cash is scarce the use of share-based pay to form part of basic employment income may be taken for granted, but elsewhere it is expected to be used with great caution. However, it is not only the circumstances but also the history that determines the company’s position. Such history may include negative experience, like losses in connection with personal investment requirements, which may not be understood by new committee members. It is therefore essential that all committee members understand reward in the same way and can articulate this understanding when determining the principles and framework for decisions to be based on.

The role of many Audit Committees has migrated from its traditional financial focus to include risk management – hence the ARC label. As a committee, the ARC tends to bring together a wealth of financial, risk and business understanding from multiple organisations as well as sectors and, although primarily not a decision-making forum, it can add significantly to the understanding of the risk framework as well as the risk profile and provide challenges to management and insight to the wider board.

In this context, the ARC becomes a key mechanism for reviewing the risk and controls framework, testing the effectiveness of the risk process in individual businesses and doing deep-dives on specific principal or material risks. It can also be a vehicle for reviewing and testing the proposed risk appetite in advance of a plenary discussion at board level. However, the risk management role that the ARC fulfils varies between different companies reflecting scale, complexity, committee and board composition as well as different

levels of exposure to new challenges like cyber security, technology change and ESG, making it equally important to ensure that these circumstances are translated to a common understanding. This can be achieved by the ARC encouraging the organisation to take a more formal and structured approach to risk appetite. A more formal structure helps to ensure that the risk appetite framework and statement become both a governance and oversight tool for the board (and its sub-committees) as well as an executive decision-making tool, providing better line of sight to executive execution. The risk appetite statement will then support better risk-return trade-offs and enable the business to consider the level of risk that it is willing to take in pursuit of its strategic, commercial, operational and financial objectives. See an illustration below of what the key dimensions are that could deliver a shared understanding.

To achieve a shared understanding, committees need to spend time considering the fundamental aspects of subjects like risk and reward and their interactions, which is helpful for the development of both remuneration policy and risk appetite statements. If the work can then extend into the whole board, or at least a joint session between the ARC and the RemCo, the shared understanding will be further enhanced so that it doesn’t fail in areas of overlap. The ARC needs to be cognizant of the risk implications (both financial and reputational) of changes to the reward strategy and to factor this into its deliberations and deep dives on specific risks or indeed, the risk processes in key businesses and functions. Equally, the RemCo should take into account any changes to the risk appetite when considering changes to the reward strategy.

Shared understanding helps to bridge different points of view and enables better dialogue within the board but it is also essential to be aware of the dangers of ‘group think’ so that principles, articulated into reward philosophy and policy and risk appetite, are not written in stone, creating self-imposed barriers to needed change. In addition, the committee Chairs have a key role in surfacing both conscious and unconscious biases to ensure that the discussions and proposed approaches for the business in question are fit for purpose and reflect a ‘best possible outcome’, for the organisation.

Information flows

To help ensure that common understanding does not lead to the creation of barriers to change and new ideas there also needs to be an appropriate flow of information to the committee, to then filter and escalate to the board as appropriate. Unsurprisingly, the two main information flow concerns we observe are, first, if the committee fails to articulate what information it needs and, secondly, where the organisation fails to provide the committee with that information due to inappropriate filtering, lack of information or poor communication of available data.

The information flows to the ARC are relatively straight-forward as they pertain to defined financial information, controls information and risk reporting. Notwithstanding this, there

can be considerable variation in the timeliness and quality of financial and risk information flowing to the ARC, not least within emerging areas like sustainability, which needs to be addressed to allow the committee to discharge its mandate in an effective manner.

Equally, the ARC can support in improving the information flow to the RemCo in relation to alternative performance measures and the discussions and decisions that impact the profile and exposure for Principal Risks as well as utilisation of risk appetite for reward.

For the RemCo the information flow most discussed tends to be the acquisition and analysis of market data for levels of reward. But since most executive compensation depends on links to performance it is information for incentive design that will most likely trigger challenges from different stakeholders. Many committees find it difficult to gain sufficient understanding of the probabilities attached to the consequences of actions and behaviours in order to determine the desired performance/ reward relationships. The starting point of equating the level of compensation that one wants to pay for expected performance outcomes, such as the budget, may be relatively straight- forward. However, where committees often struggle is to then calibrate threshold levels of performance, below which it would be unacceptable to reward someone, and stretching levels of performance, at which either incentives are capped or not expected to be achieved.

To be able to set or assess appropriate performance/reward relationships or risk processes requires that data be provided by management. We suggest that helpful first steps to determining what the committee’s information requirements are would be to:

- Determine a standard agenda for each of the planned meetings of the annual committee cycle;

- Define the minimum amount of information required for each agenda item, eg primary information for key risks plus secondary data in the form of key accounting items and ratios;

- Clarify the purpose of the required information to help management understand its value and how it will be used; and

- Define the process flow and responsibility for validating the data, including whether the committee can take outside help. For example, finance and risk functions prepare management information and performance data for their respective areas and validation is undertaken by assurance functions internally or externally.

Complexity of solutions and processes

Having a common understanding and access to the right information may still not be enough to address the complexity inherent in the subject matters of the committees. Many committees struggle to determine the level of complexity appropriate for the situation. One of the challenges typically facing the ARC is that both the business and the environment in which it is operating are becoming increasingly complex. This will have an impact on the risks, exposures, risk appetite and indeed the compliance requirements that the ARC needs to relate to and define appropriate processes for.

In tackling the complexity of a subject, it is sometimes necessary for the process to be more rigorous. ARCs would benefit from encouraging the business, and indeed the board, to embrace new approaches to risk assessment, scenario modelling and risk appetite processes to help ensure that the Principal Risks and the way they are being managed at both Group and Business Unit level reflects the nature, scale and industries in which the business is operating. Therefore, at a minimum, the following improvements should be considered:

- Increase frequency and rigour of Principal Risk discussions and reviews. A yearly review and to go through last year’s Principal Risks is not sufficient;

- Move risk assessment from looking at risks in isolation to capturing interdependencies or aggregations through more effective scenario modelling;

- Move away from using simplifying assumptions such as symmetrical risk distributions to better capture the uncertainty in the business and risk environments; and

- Embrace the emerging regulatory requirements to address financial and business model viability in multiple time horizons with clearer links between the underlying risk scenarios and the viability considerations and disclosures.

For the RemCo the complexity question usually comes up in relation to the design of incentives. Committees find it difficult to combine the complexity of the business with the complexity of the pay and performance relationship. Sometimes this is exacerbated by not differentiating between the complexity perceived by an outside stakeholder and that of an informed participant, often adding further confusion through cognitive bias. To address this the committee needs to discuss and determine what complexities:

- It is not allowed to live without (eg regulatory requirements);

- What it can’t live without (eg performance measures critical for the business or its owners);

- What it wants to retain (eg linked to a specific behaviour or action); an

- What it should seek to remove (eg obfuscating features).

In addition, complex reward matters are sometimes ignored or pushed down the agenda. For example, incentives are typically much less complex than pensions, mobility, insurance or termination arrangements, not to mention the total reward picture that encompasses all these remuneration vehicles, but the focus tends to follow items that are understandable to most. It is therefore essential that a committee challenges itself and management, to ensure that there are no risks or unnecessary costs overlooked by oversimplification of required rigour or ignoring what is both complicated and superfluous.

Conclusion

Effective board committees have become key to successful and well-functioning boards and corporate governance. That effectiveness relies first and foremost on the combination of leadership, diverse expertise and experience and purpose. However, we have made the case that the contribution of committees can be improved by putting increased emphasis on shared understanding and common reference points, providing the right information to support decision-making, challenge and review and having a considered approach for dealing with the inherent complexity of the considerations of each board committee.

If you've enjoyed this content, subscribe today for

3 months free of our exclusive governance insights.

Register to receive our FREE Interim newsletter which alerts you to the latest information about the fast-developing world of corporate governance.